Four tips for millennials looking for a mortgage

You’re kind of a big deal. Your generation, millennials, passed baby boomers in April to become America’s most populous generation, according to Pew Research Center.

You’re kind of a big deal. Your generation, millennials, passed baby boomers in April to become America’s most populous generation, according to Pew Research Center.

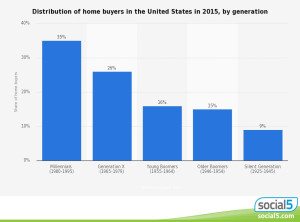

Not only that, but millennials like you account for 35 percent of home buyers in the country — a far bigger percentage than any other generation.

That’s good news, because lenders must tune into the needs and wants of your generation. In fact, another Pew Research Center report found that millennials are largely behind lenders’ implementing technology-driven mortgage processes. But no matter how you apply for a mortgage, it doesn’t change the basic requirements for a successful loan application. With that in mind, here are four mortgage tips for millennial home buyers.

Watch your work history

No one expects you to stay with the same company for 35 years, but lenders want to see consistency and advancement within your industry. Jumping from full-time to freelance or switching among several unrelated roles may count against you. Be prepared to explain any inconsistencies during the two years previous to your application.

Maintain great credit

According to mortgage software company Ellie Mae, the average FICO credit score for millennials applying for mortgage loans in 2015 is 723. While that’s not in the rarified air near the top of FICO’s 850-point scale, it’s still a good credit score. Like with your employment, lenders are looking for consistent handling of any credit extended to you: student loans, rent payments, car loans, credit card debt, etc.

Get pre-approved

Pre-approval means that your financial situation has been verified by the lender. It’s more involved than pre-qualification but still relatively simple. You’ll fill out a mortgage loan application and provide the necessary supporting documentation. The lender will examine your financial situation and decide what interest rate to offer and the maximum amount you would be permitted to borrow. Pre-approval does not guarantee a mortgage loan, but it gives you a solid idea of what you can afford.

Don’t rely only on the internet

Determining the type of mortgage that’s best for you is complicated. While you will likely find helpful information — like this post — online, when you’re ready to get serious about a mortgage, talk to an expert. A mortgage lender can guide you with products best suited to your financial situation.